If you’re cruising through your 40s or 50s thinking, “I’ll worry about that later,” when it comes to long-term care insurance—you’re not alone. But here’s the truth bomb: you need long-term care insurance before you turn 60 years old, and waiting can cost you big—financially and emotionally.

Let’s unpack exactly why locking in a policy before 60 might just be the smartest move you can make for your future self.

Understanding Long-Term Care Insurance

What Is Long-Term Care Insurance?

Long-term care insurance (LTCI) is a policy that covers the cost of care services when you’re unable to perform daily activities like bathing, dressing, or eating due to chronic illness, disability, or cognitive impairment. Unlike health insurance or Medicare, it’s designed specifically to pay for long-term assistance.

Who Needs It and Why?

Spoiler alert: Nearly everyone. Studies show that 70% of people aged 65 and older will need some type of long-term care. Whether it’s in-home help, assisted living, or nursing home care, these services add up fast—and most of us aren’t prepared to foot the bill.

What Services Are Covered Under Long-Term Care?

Long-term care insurance usually covers:

- Home health care

- Adult day care

- Assisted living

- Nursing home care

- Hospice and respite care

Basically, it picks up where health insurance and Medicare stop.

The Rising Cost of Care

Typical Long-Term Care Expenses Across the United States

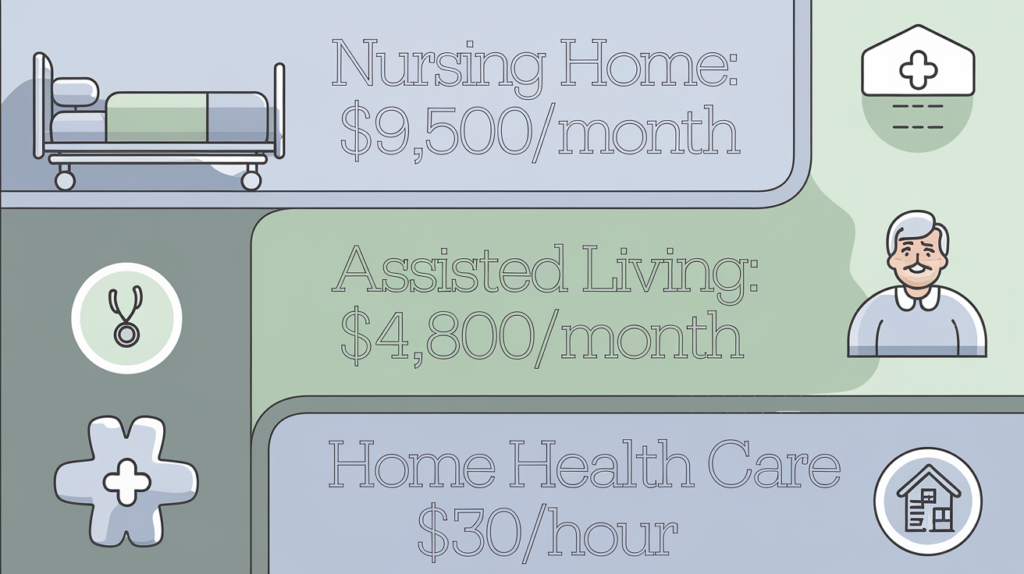

Let’s break down the numbers. Based on the 2025 Cost of Care Survey by Genworth:

- A private room in a nursing home averages $9,500/month

- Assisted living costs around $4,800/month

- Home health aides can cost $30/hour

That’s a serious chunk of change.

The Financial Burden Without Insurance

If you’re thinking you’ll pay out-of-pocket, think again. Even a modest level of care can deplete retirement savings quickly. Without insurance, families often end up dipping into their assets—or worse, going into debt.

How Costs Are Expected to Grow Over Time

Care costs are projected to rise 3–5% annually. That means in 10 years, those $9,500/month nursing home bills could balloon past $12,000. That’s why you need long-term care insurance before you turn 60 years old—the earlier, the cheaper, and the better protected you’ll be.

Why Age 60 Is the Cutoff You Can’t Ignore

Premiums Skyrocket After 60

Here’s a reality check: the older you are when you apply, the higher the premium. A policy purchased at age 55 might cost $2,000/year. Wait until 65? That same policy might be $3,500/year—or worse, denied entirely.

Health Conditions May Disqualify You

The longer you wait, the higher the chance you’ll develop health issues that make you ineligible. High blood pressure, diabetes, past surgeries—even minor conditions can lead to rejection or higher costs. That’s another reason you need long-term care insurance before you turn 60 years old.

Early Enrollment = Better Benefits

Applying early often means:

- Lower premiums

- Higher benefit options

- Longer benefit periods

- Easier underwriting approval

It’s like buying a safety net before you even realize you’re walking a tightrope.

Common Misconceptions About Long-Term Care Insurance

“Medicare Will Cover It, Right?”

Nope. Medicare covers short-term rehab, not long-term custodial care. Big difference.

“I’m Too Young to Worry About That”

Reality check: Policies are cheaper and easier to get when you’re younger. The best time to buy? Between ages 50–60. That’s why you need long-term care insurance before you turn 60 years old—you’ll never be younger or healthier than you are now.

“I’ll Self-Insure” – Why That’s Risky

Unless you’ve got millions tucked away, self-insuring is risky business. And even then, why spend your own money when you can pay a modest premium for full protection?

Real-Life Scenarios That Show the Importance

Case Study: Planning Ahead Saved a Family

Linda bought a long-term care policy at 55. At 68, she was diagnosed with Parkinson’s. Her policy now covers over $6,000/month in care costs, giving her family peace of mind—and saving her retirement fund.

Case Study: Waiting Too Long Created a Crisis

John waited until 63 to apply. He had recently developed diabetes and was denied coverage. Three years later, early-onset dementia left his family scrambling to cover a $7,000/month care facility out of pocket.

Tips for Picking the Best Long-Term Care Insurance Policy

What to Look for in a Policy

Key features to compare:

- Daily benefit amount

- Benefit period

- Elimination period (waiting period before coverage starts)

- Inflation protection

- Covered services and settings

Comparing Policies and Providers

Use online comparison tools or consult with independent brokers. Ratings from A.M. Best, Moody’s, and Standard & Poor’s can also help you vet insurance companies.

Questions to Ask an Insurance Agent

- What does the policy not cover?

- Can benefits be shared between spouses?

- How do premiums increase over time?

Ask smart questions—your future self will thank you.

Alternatives to Traditional Long-Term Care Insurance

Hybrid Policies (Life + LTC)

These plans bundle life insurance with long-term care coverage. If you don’t end up needing the long-term care benefits, the life insurance payout still goes to your beneficiaries—so either way, it’s a smart move.

Long-Term Care Riders on Life Insurance

Some life insurance policies offer LTC riders that allow you to use the death benefit to cover care expenses.

Health Savings Accounts (HSAs)

HSAs can be used tax-free to pay for long-term care premiums—just another reason why planning early is gold.

Tips for Getting the Best Policy Before You Turn 60

Start Shopping in Your 50s

Start looking at options around 50–55. That sweet spot gets you lower rates and more flexibility.

Work with a Licensed Broker

A broker who specializes in long-term care insurance can help you navigate the maze, compare policies, and save money.

Understand the Elimination Period and Daily Limits

Make sure you know how long you’ll need to wait before benefits kick in and how much your policy pays per day. Don’t leave it to chance.

Wrapping It All Up

You wouldn’t wait until your house catches fire to buy insurance, right? The same logic applies here. You need long-term care insurance before you turn 60 years old because after that, your options shrink, costs rise, and your health risks increase.

This isn’t just about money—it’s about peace of mind. For you. For your spouse. For your kids. Planning ahead means having control when life throws the unexpected your way.

So don’t put it off. Start looking into your options now and lock in a policy while you’re still ahead of the game.

Public Liability Insurance Act 1991: A Complete Guide for Businesses and Individuals

FAQs About Long-Term Care Insurance

Can I still get long-term care insurance if I’m over 60?

Yes, but it’ll likely cost more and may be harder to qualify for due to health issues. That’s why it’s smarter to buy before 60.

What if I never use my long-term care insurance?

If you never use it, consider it peace of mind insurance—like auto insurance. Hybrid policies may offer life insurance benefits if unused.

Is long-term care insurance tax-deductible?

Yes, premiums may be tax-deductible depending on your age and whether you itemize deductions.

What’s the best age to buy long-term care insurance?

Most experts recommend between 50–60. That’s when premiums are affordable and you’re likely to be in good health.

Can I customize my coverage options?

Absolutely. You can choose benefit amounts, coverage duration, inflation protection, and more to suit your needs and budget.